African women-led asset managers laying the foundations

The African Women Impact Fund (AWIF) is a pan-African gender-lens initiative of the UN Economic Commission of Africa (ECA), the African Women Leadership Network (AWLN), UN Women, and the African Union Commission. AWIF falls under the Financing pillar of the AWLN that aims to bridge the funding gap faced by African women entrepreneurs.

Challenges faced by African

women entrepreneurs

1/4

of all African businesses are started or run by women, making Africa the highest proportion of women entrepreneurs globally

OECD research

2094

the year women empowerment and gender equality will be achieved at the current pace

UN Stats, 2023

12%

of senior GPs in sub-Saharan African PE/VC firms are women. One of the principal reasons for this disparity in funding for women founders

IFC research

African Women Impact

Fund mission

AWIF aims to strengthen economic empowerment and financial inclusion of women in Africa, by accelerating the growth and development of women fund managers on the continent. In doing so, AWIF will promote the UN’s Sustainable Development Goals (UN SDGs), primarily UN SDG 5 (Gender Equality) and SDG 8 (Decent Work and Economic Growth) on the continent. African women financial inclusion is our objective.

Address African Gender Challenges

AWIF will address social challenges hindering the achievement of the UN Sustainable Development Goals 2030 and the AU Agenda 2063.

Creating a sustainable and scalable platform.

We will support and accelerate the development of African women fund managers by creating a sustainable and scalable platform that helps promote women-led startups.

Help institutional investors achieve their impact goals.

AWIF solutions constructed to help investors achieve their investment goals in a meaningful way.

Our Fund’s strategy – A gender inclusive African economy

Our objective

AWIF aims to establish a robust ecosystem that empowers and supports African women fund managers, enabling them to capitalise on investment opportunities more effectively. This, in turn, will underpin the growth of African women-led startups.

Our strategy

AWIF aims to build a tier of women financial decision-makers and fund managers, who will re-write the rules on who and what should be funded.

We will cast a wider net in tackling hurdles faced by gender-lens emerging asset managers such as:

- Lack of track record

- Insufficient exposure to institutional systems and procedure

- Lack of support networks and resistance to African women leadership

Driving impact and

measurable outcomes

African Women Impact

Fund Mandate

In identifying and selecting the AWIF fund managers, the 2X Challenge criteria is applied, modified to best serve the purpose of the Fund. The requirements are as follows:

Entrepreneurship

51%

women ownership or the business is founded by a woman.

Leadership

51%

women making investment decisions.

Employment

30-50%

share of women in the workforce (depending on sector)

African Women

Impact Fund Series

Africa is an attractive investment destination for investors looking to diversify their portfolios and tap into new growth opportunities. However, due to a lack of data, many investors are often unaware of available opportunities, especially in women-led startups and women entrepreneurs.

African Women Impact Fund Series addresses these challenges of investors and provides access to the many profitable opportunities of investing in women.

Key features towards gender inclusion

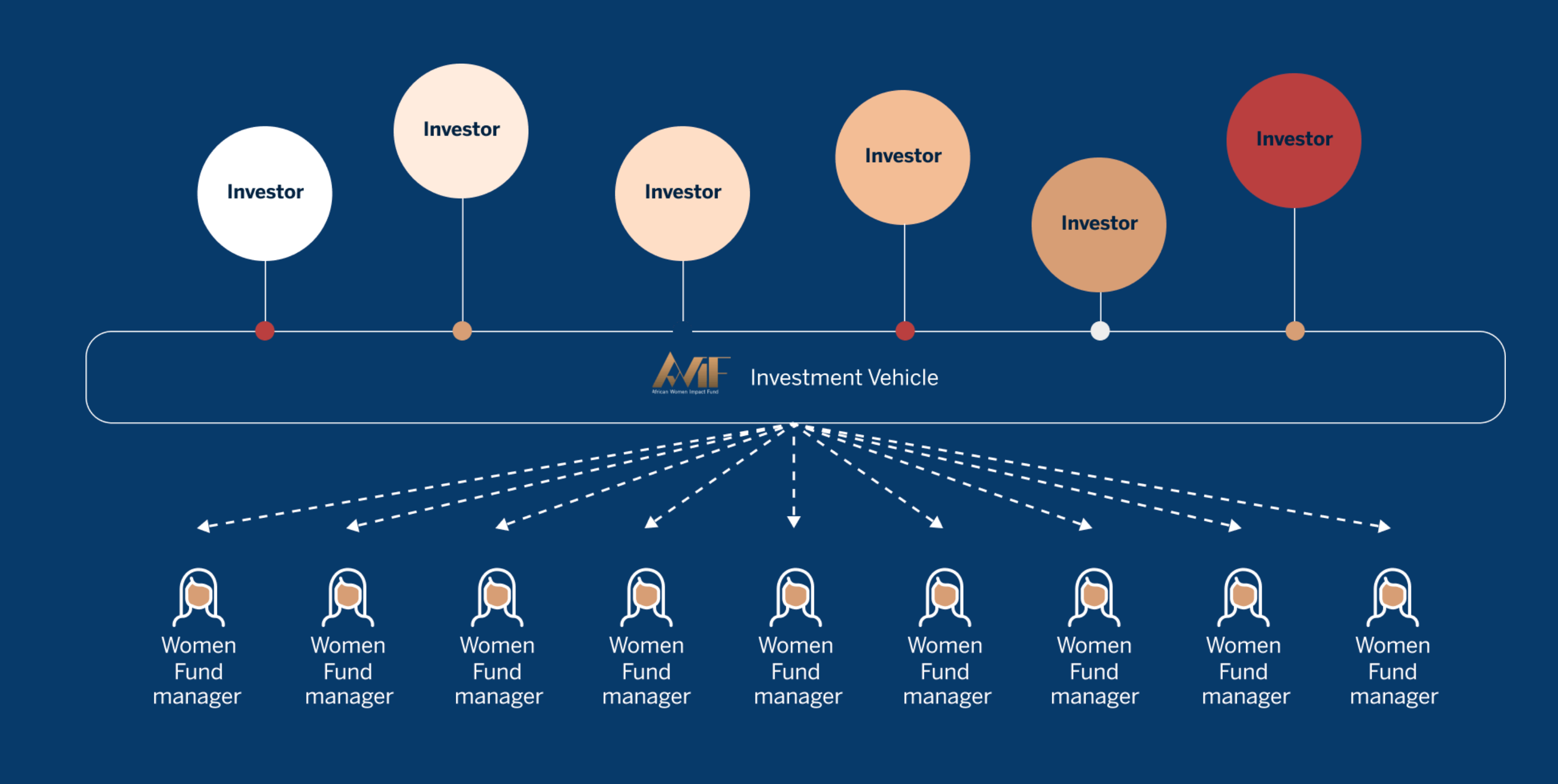

We will use investment capital to assist managers to acquire a solid track record, expand their scale, and diversify their client base. Through the women fund managers, the Fund will pursue investments that have positive impacts and deliver measurable social and environmental benefits. The African Women Impact Fund’s platforms allow:

- For the crowding in of smaller investors who would like to have broad-based impact on women fund managers

- The provision of a consistent capital platform for the growth and development of women fund managers

- For active women manager development that is key to impact and risk management

The Benefits of the African Women Impact Fund Series

A single structure that can ensure measurable scale and manage costs.

Outsourced monitoring and risk management.

Superior performance with lower risk profiles over long term, after costs.

Liquidity and concentration risk management through manager, country, asset class, and sector diversification.

Smaller managers to receive funding from large institutional investors in manageable sizes.

AWIF will be diversified across asset classes, African regions, and high-impact sectors.

FSDR Disclosures. Read the UN’s Financing for Sustainable Development Report here

AWIF Foundation: Promoting the emergence of African women entrepreneurs

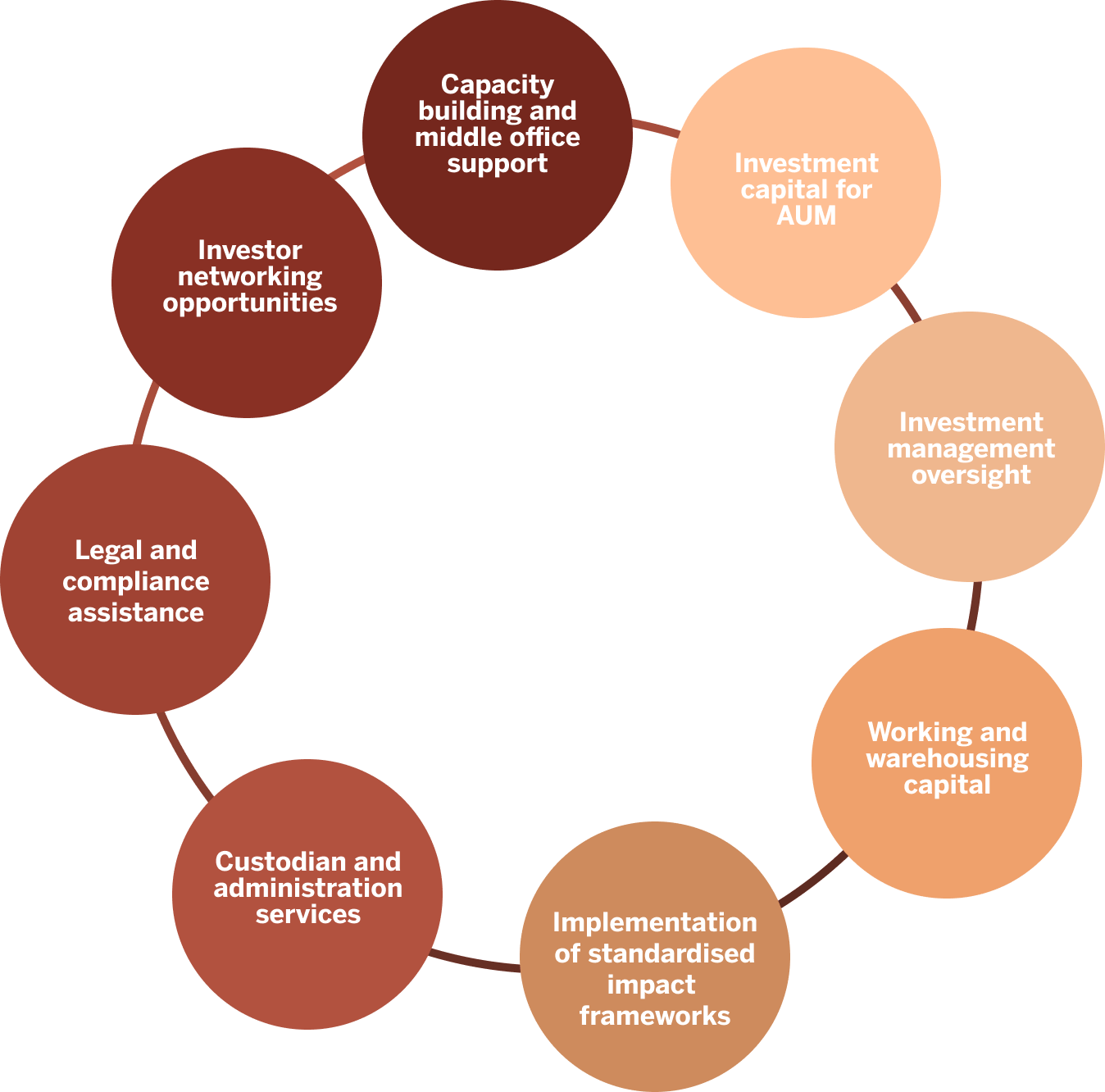

The AWIF Foundation was created to support the objectives of the African Women Impact Fund: providing working capital for operational assistance to women fund managers, especially those who are on their fundraising journey.

Establishing impact investment funds with an accompanying incubation facility that targets the identified hurdles of women fund managers is necessary to promote the emergence of African women fund managers.

AWIF Foundation: Accelerating the growth and development of African women fund managers

African Women Impact Fund will, through the Foundation, provide tailored support to address weakness in women fund managers’ operating and/or investment processes including:

- Capacity building, middle office support, systems and procedures to allow selected fund managers to accelerate their growth and expansion plans

- Providing access to best-practice consultants and technical resources to mitigate downside risks and accelerate the fund manager learning curve